We recommendation is:

How to apply Discover it Cash Back Credit Card

In 1985, when numerous independent retailers and companies started offering their consumers branded credit cards for their own stores, a Sears subsidiary founded Discover.

Discover rapidly set itself apart from its rivals by not imposing an annual charge and providing one of the earliest cash-back rewards programs.

Due to the limited willingness of rival businesses to accept the Sears department store card, Discover initially grew slowly. However, this did not discourage Discover, who gradually grew its network and is now accepted in 200 countries and 99% of merchant locations that take credit cards.

Discover is the seventh-largest card issuer worldwide as of 2021.

Important Takeaways

- The Discover brand of consumer credit cards is well-known for its fee reductions and cash-back rewards program.

- Without using intermediary bank issuers, Discover Financial offers credit cards directly to its consumers, making a profit from the interest on their outstanding amounts.

- Discover has an additional motivation to persuade users to use their cards for more frequent borrowing than those of their rivals given the nature of their business.

Who Controls Discover?

Initially owned by Sears, then by the financial services giant Morgan Stanley, Discover became an independent business in 2007.

The Operation of Discover Cards

Instead of simply licensing the use of its brand name to issuing banks, which then offer, for instance, Visa-branded credit cards to their customers, Discover actually issues credit cards directly, using its own brand. This makes Discover’s business model more analogous to that of American Express, which is also a direct issuer. Compared to Visa, which simply licenses the use of its brand name to issuing banks, American Express and Discover are both direct issuers.

Benefits of the Discover it® Cash Back Credit Card

The Discover It Cash Back Credit Card has gained popularity for a number of reasons, including the following:

No Annual Fee

The fact that there are no annual fees associated with this card is one of its primary selling points. Because of this, it is a good choice for people who are just starting to develop their credit or who want to avoid spending money on things that aren’t necessary.

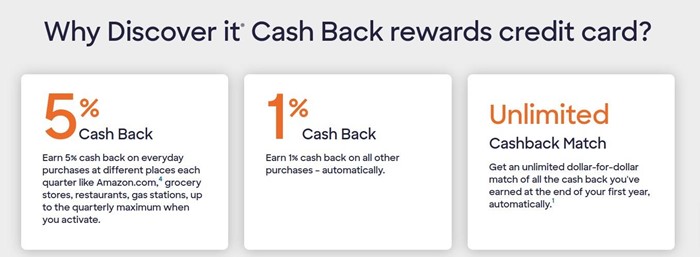

Rotating 5% Cash Back Categories

The rolling categories that qualify for a cash back reward of 5% on this card are refreshed every three months. These categories include a wide range of day-to-day expenditures, including those incurred at Amazon.com, grocery stores, restaurants, and gas stations.

1% Cash Back on All Other Purchases

In addition to the variable categories, the card awards a flat rate of 1% cash back on all other purchases, ensuring that you will continue to accumulate rewards regardless of the type of purchase made.

No Limits on the Amount of Cash Back Matches

It’s not a surprise that the unlimited cash back match that you get at the conclusion of the first year with the Discover It Credit Card is one of the most enticing features of this credit card. This implies that any cash back you have earned will be doubled, thereby delivering a 10% cash back rate on the rotating categories, and a 2% cash back rate on any other purchases made during that year.

Support for Customers That Is Beyond Compare

Discover’s unmatched customer care is comparable to that of more expensive credit cards, and it is available around the clock in the United States and Canada.

Protection Against Fraud

For your peace of mind, the card comes with comprehensive security for your online privacy, monitoring for your Social Security number, and a liability guarantee of $0 for fraudulent charges.

Who is qualified to apply for the card?

The minimum credit score required for Discover it® Cash Back Credit Card is 700, (and it must be higher no lower). Therefore, in order to qualify for the card, applicants must have credit scores of at least excellent. Having said that, this credit score criteria is equivalent to those of the majority of the other cards that Discover offers, as well as other issuers’ requirements for comparable cash back credit cards.

Discover will also take into consideration the applicant’s recent credit queries, the number of credit lines or loans they currently have open, the amount they pay each month for housing, and other factors. In addition, if you already have two active Discover cards, your application for a third one will be denied. That’s the most that can be done.

Find out if you are “pre-approved” for the Discover it® Cash Back Credit Card by filling out the form online. This is the first step in determining if you are qualified to apply for the Discover it® Cash Back Credit Card. After providing some personal information such as your name, residence, income, and date of birth, you will be presented with a list of Discover cards for which you have a good chance of being approved, along with links to submit an application for each of these cards.

Making payments with your Discover Card

Due to the fact that Discover issues cards to customers on a direct basis, payments are submitted immediately to Discover. You can do this by calling the number that is printed on the back of your card, sending your payment in the mail along with the payment stub that is printed on your bill, or logging into your Discover online account and paying individually or setting up automatic payments.

How to Contact Discover

U.S. 1-800-DISCOVER

1-800-347-2683 (English/Español)

Available to help you 24 hours a day.

OUTSIDE U.S.

1-224-888-7777 (English/Espanol)

TDD 1-800-347-7449

Customer service – general inquiries

Discover Financial Services P.O. Box 30943 Salt Lake City, UT 84130-0943

Website

Our Opinion

Discover it Cash Back is one of the most valued everyday cash-back cards on the market as a result of the powerful rewards and perks that come with using the card. Even if the market for credit cards for beginners has changed, the Discover It Credit Card is still a good option for people who are just beginning to build their credit history. It is a fascinating choice on account of its distinctive characteristics, which include an unrestricted cash back match and dependable customer assistance.